What to Do After a Car Accident?

Your heart beats very fast against your ribs. That awful sound of metal can be heard in your ears. In the confusing moments after a car accident, it’s normal to feel scared and confused. I’ve felt that way before, after getting into a car accident on a rainy highway. I remember the thrill and the fear of what might happen. It’s important to know what to do after a car accident, though, because things can get crazy quickly. This isn’t just a list; it’s a proven plan to help you move from panic to safety, protecting both your health and your funds.

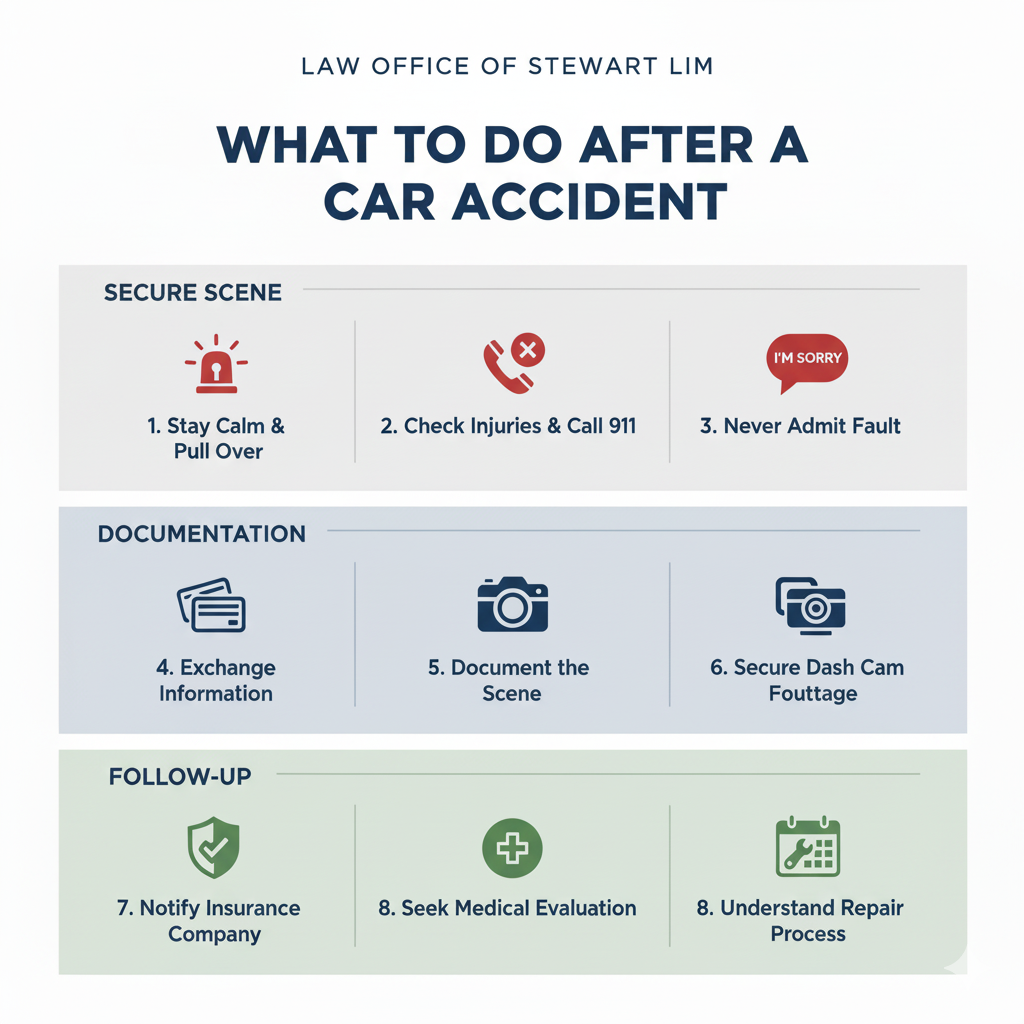

First 5 Minutes: Secure the Scene and Your Safety

Taking action right away can keep things from getting worse and set up conditions for a smooth insurance process.

1. Stay Calm and Pull Over Safely

Take a deep breath. Fear is the enemy. Put on the emergency lights to let other cars know you’re there. If the cars can still be driven and the damage isn’t too bad, move them to a side street or a parking lot so it doesn’t stop traffic and cause another accident. If the damage is severe or there are injuries, leave the cars where they are.

2. Check for Injuries and Call 911

Your health is the most important thing. Check yourself and your passengers for any injuries, then check on the passengers of the other vehicle. Call 911 immediately if anyone is hurt, no matter how minor it seems. According to the National Highway Traffic Safety Administration (NHTSA), a police report is important for your insurance claim and is legally required in many states for accidents involving injuries.

3. The Golden Rule: Never Admit Fault

This is the most important step. A nice, sincere “I’m so sorry!” can be taken the wrong way by the other driver’s insurance company and used against you. You don’t know the whole thing yet. Treat them with respect and help them out, but only share knowledge. Let the proof and the insurance adjusters decide who is at fault.

The Information Gathering Process: Build Your Case

After the scene is safe, it’s time to carefully write down everything that happened. This is how you keep yourself safe from false claims.

4. Exchange Information Correctly

Get the following from the other car while staying calm. It is faster and more accurate to use your phone to take pictures of their records.

- Full Name and Contact Information

- Insurance Company and Policy Number

- Driver’s License and License Plate Number

- Make, Model, and Color of the Vehicle

5. Document the Scene Like a Pro

Your phone’s camera is your best witness. Take photos of:

- The entire scene from multiple angles, showing vehicle positions and traffic conditions.

- Close-up shots of all damage to all vehicles involved.

- License plates of every car.

- Street signs, skid marks, and weather conditions.

6. The Power of a Dash Cam

If you have one, secure the footage. A dash cam is like a neutral eyewitness who can prove what happened without any doubt at all. This makes the claims process much easier. It’s the best thing you can buy to protect your car.

Navigating the Aftermath: The Next 24 Hours

Your actions in the hours and days after the collision are critical for your physical and financial recovery.

7. Notify Your Insurance Company

You must report the accident to your insurer as soon as possible, even if you were not at fault. Most policies require prompt reporting. Please provide them with all the details and evidence you collected. They will assign a claims adjuster to your case.

8. Seek a Medical Evaluation

Please see a doctor for a full check-up, even if you feel fine. Symptoms of common injuries, like stiffness, can show up hours or days after the injury. A medical report also keeps important records for your health and any possible Personal Injury claims.

9. Understand the Repair Process

Your insurance will guide you on where to have your car towed. An adjuster will assess the damage to determine if it will be repaired or declared a total loss. If you have rental car coverage, your insurer will help arrange a temporary vehicle.

Simple explanations of important insurance terms

| Term | Definition | Why It Matters |

| At-Fault | The driver who is legally responsible for causing the accident. | Determines which insurance company pays for damages. |

| Claims Adjuster | The insurance professional who investigates your claim. | They assess damage, determine fault, and authorize payments. |

| Total Loss | When the cost to repair a vehicle exceeds its actual cash value (ACV). | You will be paid the ACV of your car before the accident. |

| Subrogation | When your insurer recovers costs from the at-fault driver’s company. | This is how you may get your deductible back. |

Frequently Asked Questions (FAQ)

Q: What if the other driver doesn’t have insurance?

A: This is why you have uninsured/underinsured motorist coverage (UM/UIM). You would file a claim with your own insurer under this coverage to handle your injuries and damages.

Q: Will my insurance rates go up if the accident wasn’t my fault?

A: Typically, a not-at-fault accident will not cause your rates to increase. However, this can depend on your specific insurance company and the laws in your state.

Q: How long do I have to report a car accident?

A: Most policies require you to report an accident “within a reasonable time,” which typically means immediately or within 24-48 hours. For legal reporting to the DMV, timelines vary by state.

Q: Do I need to hire a lawyer?

A: Consider hiring a car accident lawyer if you have significant injuries, the fault is heavily disputed, or the insurance company denies your claim or offers a low settlement. For most minor accidents, it may not be necessary.

A Final Word of Confidence

Handling the effects of a Car accident is stressful, but you don’t have to do it alone. By following this protocol, you take control of a chaotic situation. Remember, your well-being is what matters most.

For more guidance on protecting your assets, check out the resources at The Law Office of Stewartlim to learn how to deal with life’s unexpected events. We want to help you make your future safer.