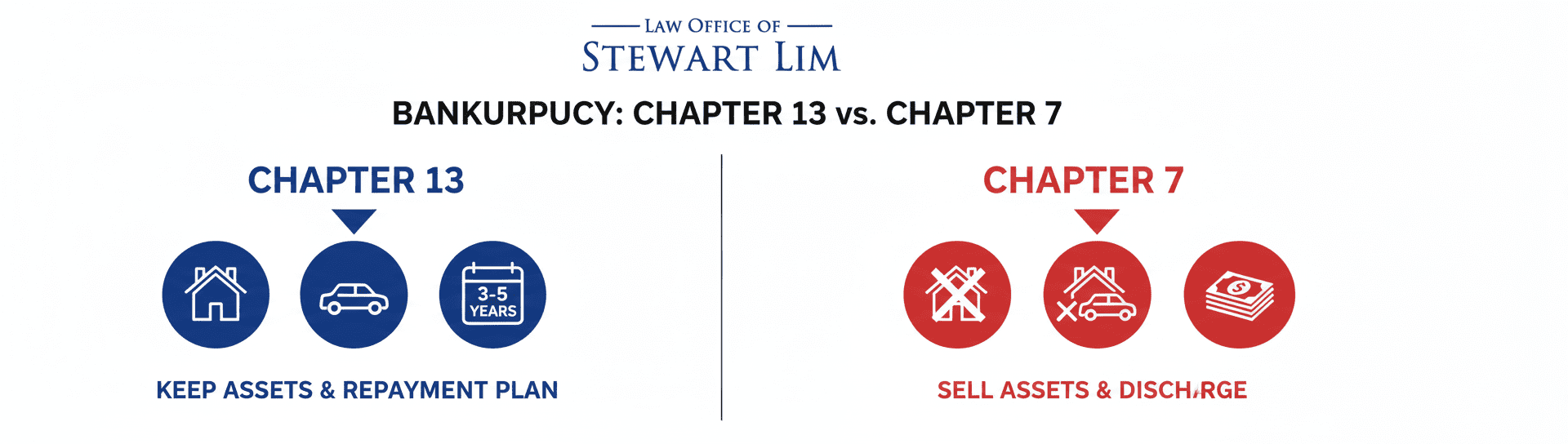

It can be stressful to file for bankruptcy, but knowing your choices can help you feel better. Bankruptcy Chapter 13 is for people who need help reorganizing their bills and have a steady income. Chapter 13 lets you restructure your debt into a manageable repayment plan, while Chapter 7 gets rid of your possessions.

We help you get back in charge of your money by walking you through the Chapter 13 process at Law Office of St.ewart Lim. This guide will explain the main steps, who can file for Chapter 13, the pros and cons, and who is eligible.

What is Bankruptcy Chapter 13?

Bankruptcy Chapter 13 is a legal way to reorganize your debts instead of erasing them.

Here’s how it works in simple words:

-

You don’t lose your property (like your home or car).

-

You make a repayment plan to pay back your debts over 3 to 5 years.

-

The court approves this plan and protects you from creditors while you’re making payments.

-

After finishing the plan, some remaining debts may be forgiven.

Chapter 13 lets you keep your property, like your home and car, while you take care of your financial responsibilities. Chapter 7 takes away your assets to pay your creditors.

How Does Bankruptcy Chapter 13 Work?

The court and a bankruptcy manager watch over your case when you file for bankruptcy under Chapter 13. Based on your budget, the trustee will look at your finances and come up with a way for you to pay back the loan. The process usually takes three to five years, and you have to make monthly payments to your creditors.

Why Choose Bankruptcy Chapter 13 Over Chapter 7?

- Keep Your Assets: Chapter 13 allows you to retain property, unlike Chapter 7.

- Stop Foreclosure: You can stop default and make up payments on the loan.

- Discharge Unsecured Debt: Some of your unsecured bills, like credit card balances, may be forgiven if you finish the plan successfully.

Who is Eligible for Bankruptcy Chapter 13?

To qualify for Chapter 13, you must meet specific eligibility requirements. Let’s get into who is eligible:

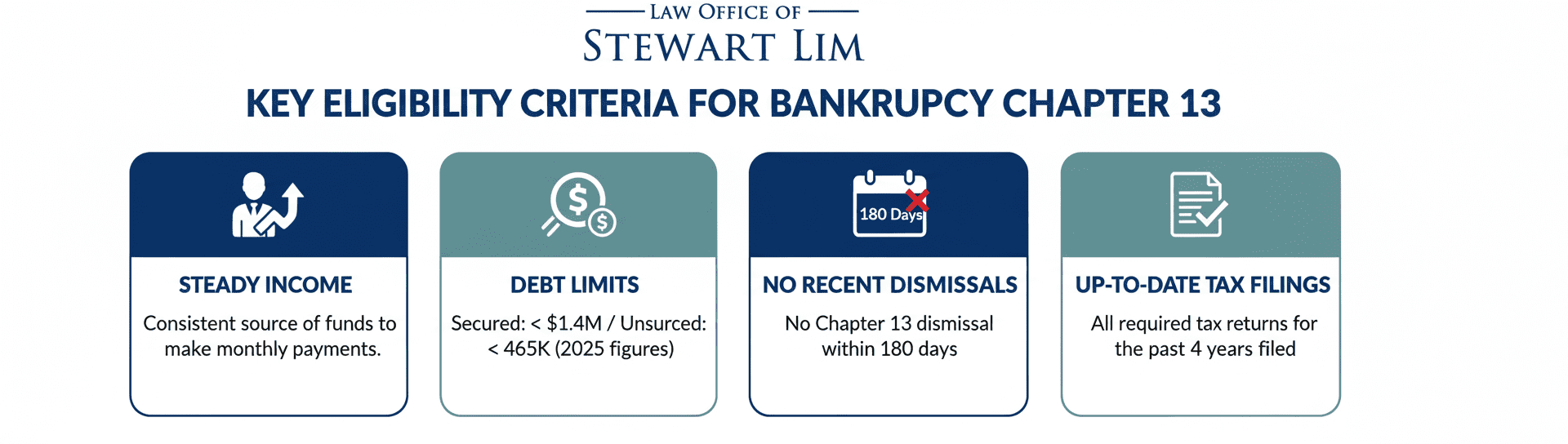

Key Eligibility Criteria for Bankruptcy Chapter 13:

- Steady Income: You must have a regular source of income that allows you to make monthly payments.

- Debt Limits: Your secured debts (like mortgage or car loans) must be less than $1,396,875, and unsecured debts (like credit cards or medical bills) must be less than $465,275 as of 2025.

- No Recent Bankruptcy Dismissals: If you’ve had a bankruptcy case dismissed within the last 180 days due to noncompliance, you cannot file for Chapter 13.

Up-to-Date Tax Filings

You must have filed all required tax returns for the past four years. Failure to do so can delay or disqualify your Chapter 13 case.

The Bankruptcy Chapter 13 Filing Process: Step-by-Step

Step 1: Filing Your Petition and Repayment Plan

The first thing you need to do is ask the court to grant Chapter 13. You must send financial papers along with the petition. These include:

- Income statements (pay stubs, tax returns)

- List of assets and liabilities

- Proof of your debts, like house, credit card, or hospital bills

The court will be given your planned repayment plan, which will show how you plan to pay back your debts over the next 3 to 5 years.

Step 2: Automatic Stay Protection

Once you file for Chapter 13, an automatic stay goes into effect. This stay stops most creditor actions, including:

This gives you breathing room while you work out your repayment plan.

Step 3: The 341 Meeting of Creditors

About 30 to 45 days after filing, you’ll have to go to a 341 meeting of debtors. Here, the bankruptcy trustee will check your financial information and make sure that the plan you’ve come up with for paying back the debt is fair. Creditors can show up, but most don’t.

Step 4: Plan Confirmation Hearing

The bankruptcy court will look over your plan to pay back your debts. The judge will either agree with your plan or tell you that it needs to be changed at the confirmation meeting. As soon as everything is approved, you’ll start making monthly payments as planned.

The Bankruptcy Chapter 13 Repayment Plan

The payback plan is one of the most important parts of bankruptcy Chapter 13. What it means is this:

- Secured Debts: Payments will be sent to debtors who hold protected debts, like mortgages and car loans.

- Priority Debts: While you are paying back some bills, like child support, taxes, and alimony, you have to pay them all in full.

- Unsecured Debts: Depending on your assets and income, you may be able to pay off your credit card debt, hospital bills, and personal loans in full or in part.

How the Repayment Plan Works

- The bankruptcy Chapter 13 trustee collects monthly payments from you and distributes them to your creditors.

- You’ll continue making payments for 3-5 years until the plan is completed. After that, any remaining debts that are qualified will be forgiven.

Advantages and Challenges of Bankruptcy Chapter 13

Benefits of Filing Bankruptcy Chapter 13

- Asset Protection: Unlike Chapter 7, you can keep your home and other assets.

- Foreclosure and Repossession Protection: This stops the removal process and helps you make up payments you missed.

- Manageable Payments: Your monthly payment is based on your income, which can lower your financial burden.

Challenges in Bankruptcy Chapter 13

- Longer Process: The repayment plan typically takes 3 to 5 years.

- Missed Payments: If you miss a payment, your Chapter 13 case can be dismissed or modified, potentially causing delays or complications.

Discharge and Completing Your Bankruptcy Chapter 13

Once you complete your repayment plan, you’ll receive a discharge for any remaining eligible debts. This means you are no longer legally required to pay those debts.

Hardship Discharge

Depending on your situation, you may be able to get your debts forgiven early if you have a hardship during the plan. This could happen if you lose your job or have a medical issue.

Costs and Fees Associated with Bankruptcy Chapter 13

Filing Fees

Filing for Chapter 13 includes several costs:

- Court Filing Fees: Depending on where you live, these can be anywhere from $300 to $400.

- Attorney Fees: Bankruptcy Chapter 13 lawyers usually charge a set price, which can be anywhere from $3,000 to $5,000. Most of the time, you’ll pay these fees as part of your repayment plan.

In the Law Office of Stewart Lim, you can start your case for $635. Free Consultation Available

Additional Costs

There may also be trustee fees that are added to your regular payments. Most of the time, these fees add up to about 10% of your regular payment.

Frequently Asked Questions (FAQs)

1. Can I Keep My Home in Bankruptcy Chapter 13?

Yes, Chapter 13 is meant to help you keep your home by giving you time to make up late mortgage payments.

2. How Long Does Bankruptcy Chapter 13 Take?

The repayment plan lasts 3 to 5 years, depending on your income and the total amount of debt you have.

3. Can I File for Bankruptcy Chapter 13 Without an Attorney?

While it’s possible to file for Chapter 13 without an attorney, it’s highly recommended to seek legal advice to navigate the complex bankruptcy process.

4. What Happens After My Bankruptcy Chapter 13 Case Ends?

After completing the repayment plan, you’ll receive a discharge for any remaining eligible debts, and you can start rebuilding your credit.

Conclusion: Is Bankruptcy Chapter 13 Right for You?

Filing for bankruptcy Chapter 13 can provide a lifeline if you’re struggling with debt but have a steady income. By reorganizing your debts and creating a manageable repayment plan, you can keep your property and get back on track financially.

If you’re considering filing for bankruptcy under Chapter 13, it’s important to work with an experienced bankruptcy attorney who can guide you through the process. At The Law Office of Stewart Lim, we’re here to help you understand your options and make the best decision for your financial future.